Ategenos Access Portfolios

Unlock the Power of Separately Managed Accounts (SMAs) Within Our Investment Process Framework

*Minimum: $500k/account

Our Access Portfolios are structured as a Unified Managed Account (UMA) to provide an elevated emerging wealth experience for investors.

Comprised of active and passive exposures gained through separately managed accounts (SMAs), ETFs, and mutual funds, these discretionary portfolios are dynamically allocated and constructed to leverage multiple alpha drivers. Through the use of SMAs, the Access Portfolios also provide investors direct ownership of both equity and fixed income securities, providing greater transparency into portfolio ownership and increased flexibility from a tax management perspective.

Discover the Ategenos Access portfolio that aligns with your client’s investment goals.

*Availability may vary based on individual firm configuration. Services may be provided by platform sponsor and/or other applicable partners. Additionally, program minimums may vary based on firm requirements.

Dynamic Asset Allocation

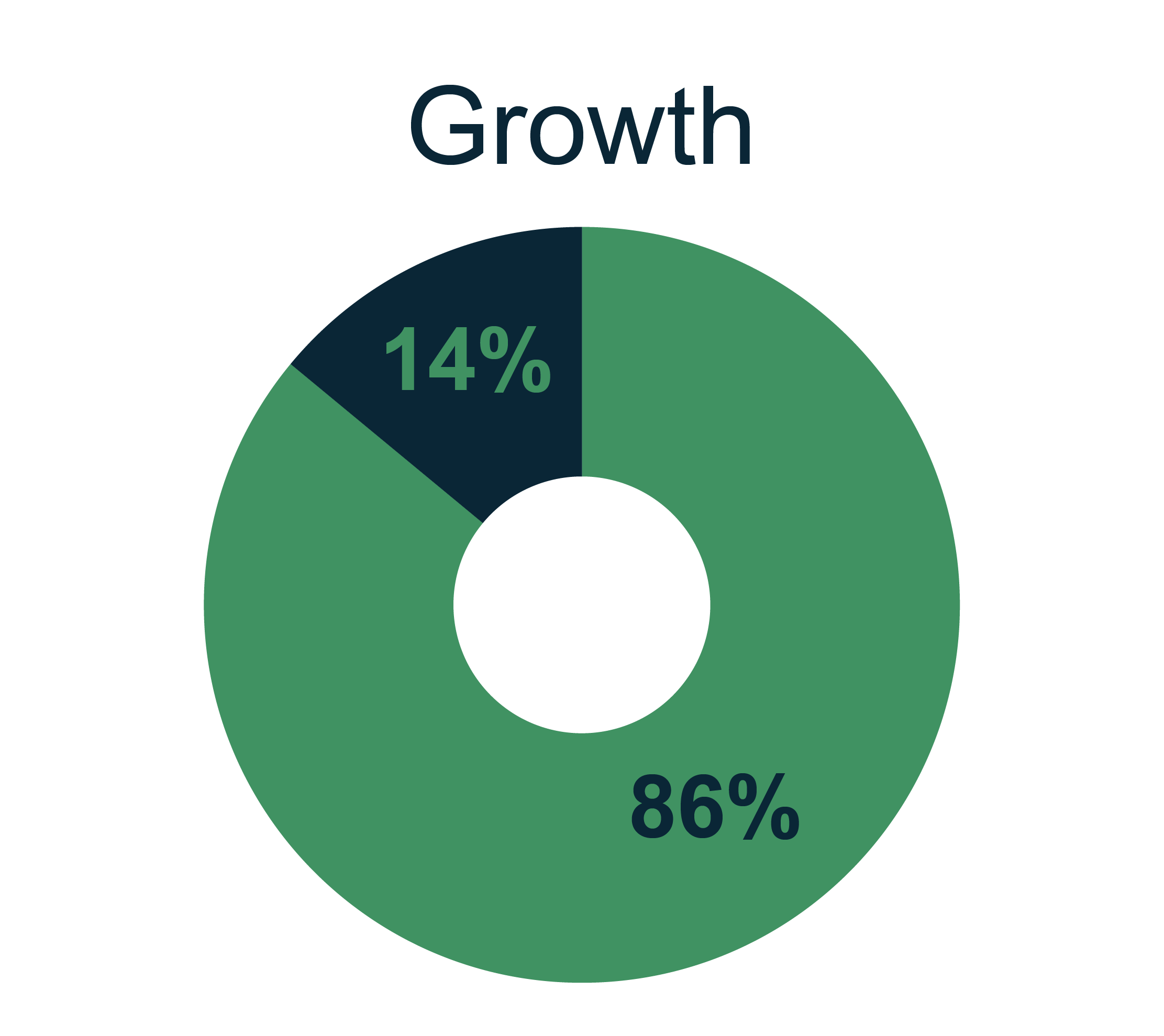

The Ategenos Access portfolios are designed to span the risk/return spectrum to meet the needs of any investor. Employing a dynamic approach to asset allocation, we complement a strategic asset allocation framework with an active overlay. Portfolios are reallocated between four and eight times per year to capitalize on opportunities derived from our investment research process.

Efficient Portfolio Construction

The Ategenos Access portfolios are constructed by complementing longer-term core market exposure with multiple alpha drivers. Alpha drivers include asset allocation tilts, thematic exposures, and actively managed underlying investment strategies. When selecting actively managed strategies, our portfolio managers leverage their decades of manager research experience. The blend of passive and active management allows for a cost-effective solution with the ability to conduct ongoing tax loss harvesting, implement customizable tax transitions, and employ impact overlay services.

Fixed Income

Equity

Portfolio may be designed to incorporate tax considerations. Asset allocation and

diversification may not protect against market risk, loss of principal or volatility of returns.