Ategenos

Retirement Plan Services

A Team Approach to Plan Success

By collaborating with your financial advisor to align with your organization’s goals, Ategenos Capital will help build an investment recommendation to meet the needs of your plan and its participants.

Ategenos Capital delivers asset allocation advice to align with the risk profiles of your employees, performs comprehensive due diligence to select suitable investment strategies for plan participants, and provides ongoing monitoring of investment portfolios and available investment strategies to ensure alignment with Ategenos Capital’s structured investment process.

Ategenos Capital

ERISA 3(38) investment manager

Delivers asset allocation advice to align with the risk profiles of your employees

Performs comprehensive due diligence to select suitable investment strategies

Provides ongoing monitoring of investment portfolios and available investment strategies

Recordkeeper/Administrator

Provides recordkeeping and administration

Provides a web-based portal for plan participants and plan sponsor

Confirms plan offered is compliant and meets current regulations in place

Provides an Annual Review to Advisor/Plan Sponsor to assist the Plan Sponsor in satisfying its fiduciary duty to monitor

3(38) Investment Fiduciary

As an investment manager with ERISA 3(38) responsibilities, Ategenos Capital acts as a fiduciary to the plan, the plan’s trustees, and its participants. All decisions made and actions performed are made in the best interests of your employees. As part of our ERISA 3(38) responsibilities, Ategenos Capital will take investment discretion over the plan. By delegating ERISA 3(38) responsibilities, the plan sponsor forgoes any obligation to invest assets of the plan for which the ERISA 3(38) investment manager is responsible.

Ategenos Capital RPS Investment Solutions

Ategenos Capital seeks to provide the appropriate amount of diversification while allowing for portfolio growth to meet the goals and objectives of retirement plan participants.

Ategenos Capital also provides a curated list of investment funds for participants to choose from in place of a model portfolio or to use as a complement to Ategenos model portfolios. A typical Ategenos Capital Retirement Plan Services program offers fully diversified Ategenos Portfolios as well as an RPS Fund List to provide additional options for plan participants.

Diversified

Ategenos Portfolios

Ategenos Portfolios are fully diversified, multi-asset class portfolios that are built and maintained by a team of experienced Ategenos Capital portfolio managers.

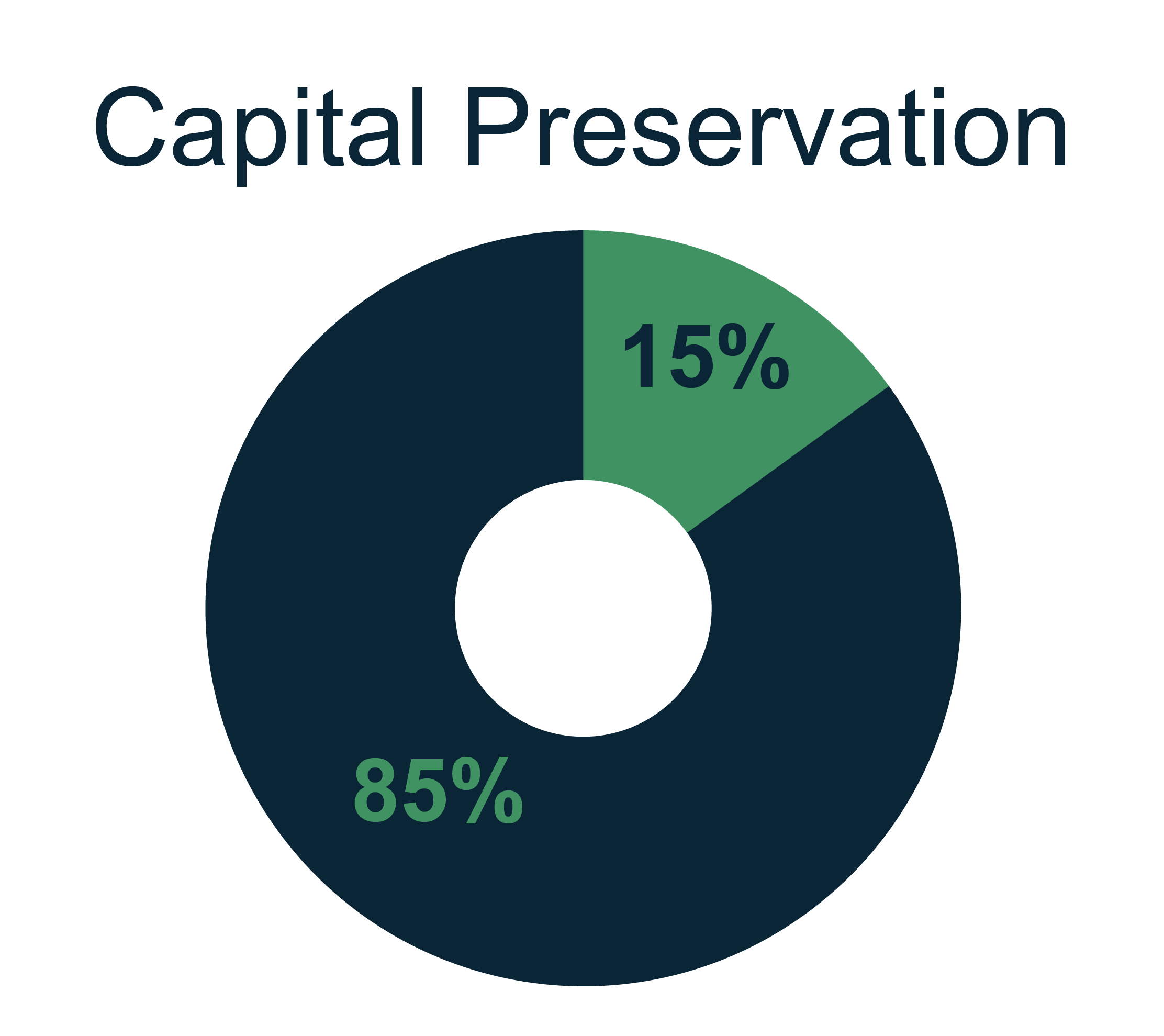

Capital Preservation

Conservative

Conservative Growth

Moderate

Moderate Growth

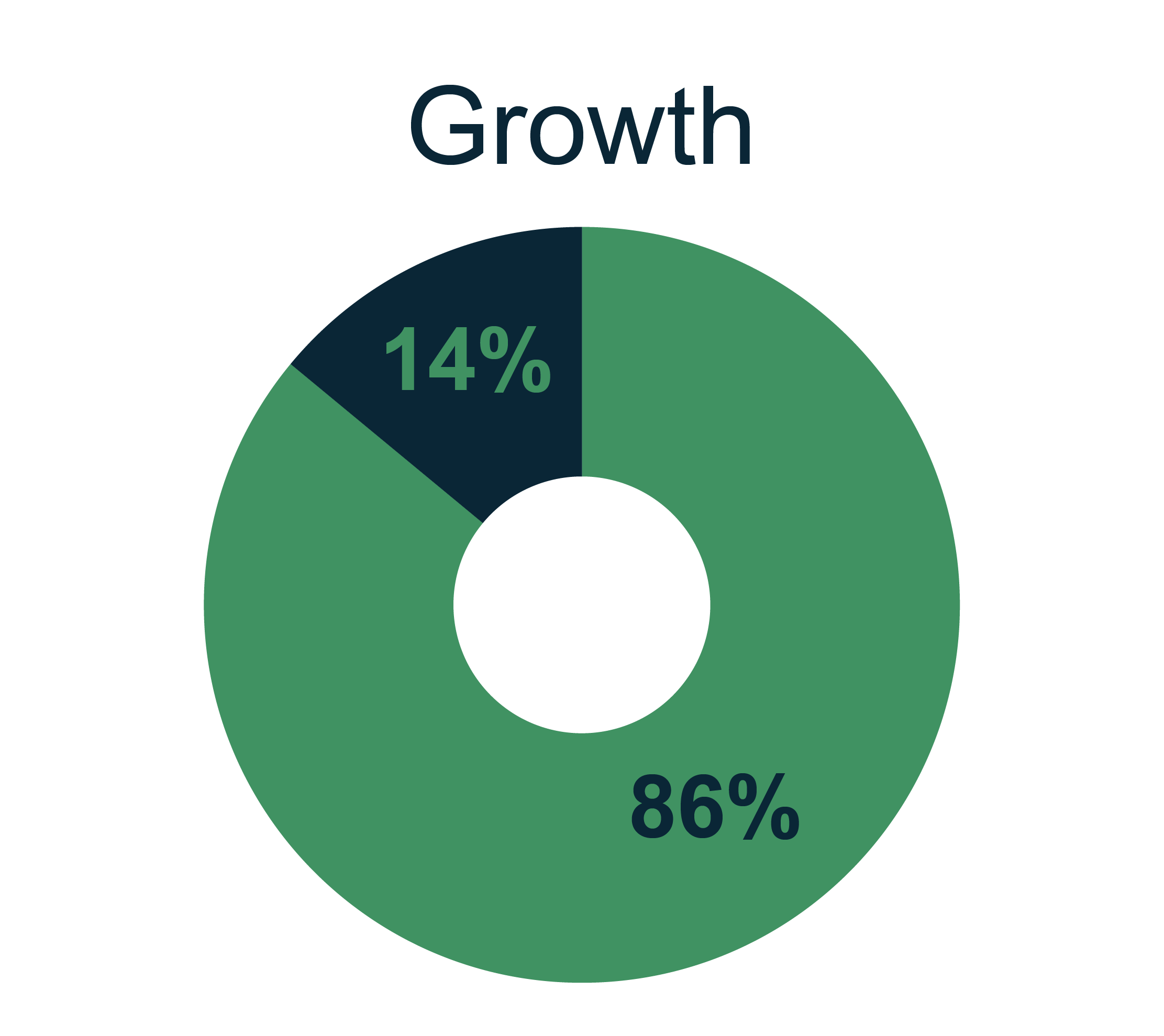

Growth

Aggressive Growth

Curated RPS

Fund List

Ategenos Capital will provide a curated list of active and passive fund options that have met our stringent due diligence requirements.

U.S. Large Cap

U.S. Mid Cap

U.S. Small Cap

International Equity

Emerging Markets

Fixed Income

Alternatives

Fixed Income

Equity

Asset allocation and diversification may not protect against market risk, loss of principal or volatility of returns.